la county tax collector duplicate bill

We are located on the first floor in Room 122. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments for the county school and community colleges and special districts.

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

August and November of the current year and February and May of the subsequent year.

. Hill Street Los Angeles CA 90012. Or call the Lake County Treasurers Office at 847-377-2323. I Want To Get A Copy Of.

These refunds are processed and issued by the Treasurer and Tax Collectors Office. Please put DUPLICATE TAX BILL in the subject heading of your email and include the Assessor ID No. 1099 Tax Form for Vendors.

LOS ANGELES COUNTY TAX COLLECTOR PO. It is also the responsibility of the tax collector to provide notice to every taxpayer his agent or representative the amount of property tax due no later than the 4th monday in november. Collectively over one million secured unsecured supplemental and delinquent property tax bills.

Online services remain available to the public via our contact form or by phone at 213 974-3211. Property Tax Installment Plans. TAXES BECOME DELINQUENT AFTER DECEMBER 31st AND BEAR 100 INTEREST PER MONTH OR ANY PART OF.

New Property Owner Information. If you do not receive a tax bill by August 1 due date please contact the Tax Collectors Office at 732 248-7228. Thank you for visiting the website Site for the Los Angeles County Treasurer and Tax Collector we us or our.

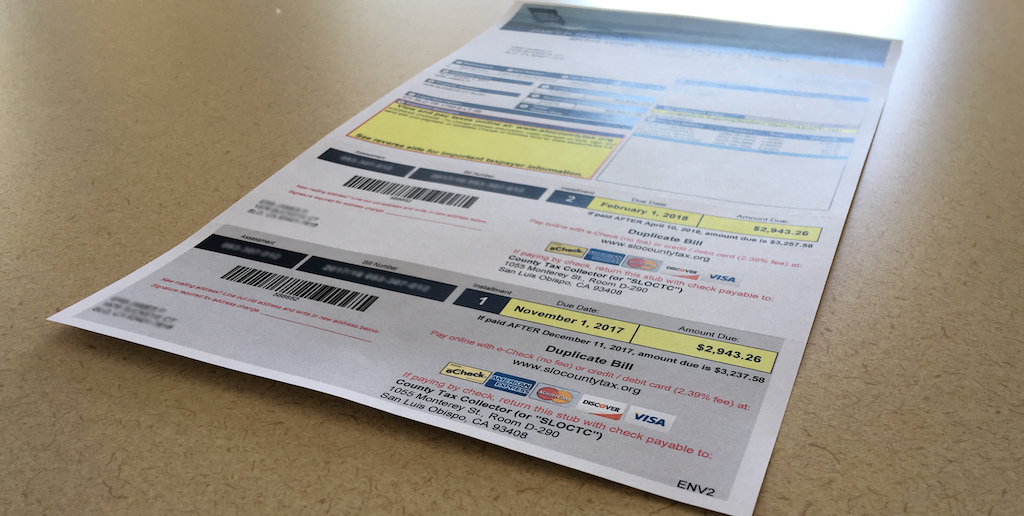

Stay Safe Stay Healthy Get Vaccinated. The 1st installment of your LA County Annual Secured Property Tax Bill is due on November 1 and becomes delinquent if payment is not received by December 10. We are located at the Kenneth Hahn Hall of Administration 225 North Hill Street Los Angeles California 90012.

Senior Citizen Property Tax Assistance. We will mail you a bill within three business days. La County Tax Collector Duplicate Bill bill county duplicate Edit Po box 99 durango co 81302 phone.

Please call 213893-7935 or visit us at 225 N. Assessor Offices will be open to the public from 800am - 500pm for limited in-person services except for the West District which remains closed until further notice. If your assessment appeal for a reduced value is denied call the Assessment Appeals Board at 213 974-1471.

You must mail your property tax payments to. You may also contact any of the Assessors Office 213 974-3211. Livingston Parish Online Tax Inquiry.

The PIN cannot be provided by telephone e-mail or fax. The Tax Bills are mailed once a year usually June or July containing four stubs for. ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE BILL FEE PER PARCEL.

Auction Book for Delinquent Properties. Annual Secured Property Tax Bills - The Annual Secured Property Tax Bill is mailed on or before November 1 of each year. Property Tax Payment History.

Do not mail your payments to any other address. The first installment payment is due November 1. The Treasurers office will refund duplicate payments to the party who pays second and will retain the initial payment received.

You should also expect to receive either one or two separate supplemental bills which are in addition to your annual bill. The County is committed to the health and well-being of the public. If you did not receive your Annual Secured Property Tax Bill by November 1 you may request a copy by calling the Treasurer and Tax Collectors automated Substitute Secured Property Tax Bill Request Line at 213 893-1103.

TO DUPLICATE PAYMENT BLOCK 2201LOT 8 WHEREAS the Tax Collector received payment on August 21 2020 in the amount of 61540 for past due utility bills due by the Law Offices of Pearl Levy for Block 2201 Lot 8 property known as 130 Hillside Avenue and. We are accepting in-person online and mail-in property tax payments at this time. COUNTY OF LOS ANGELES TREASURER AND TAX COLLECTOR Kenneth Hahn Hall of Administration.

Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values. Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. Duplicate tax bills for homeowners available at no charge.

For a duplicate bill email us at infottclacountygov. It becomes delinquent and will be subject to a 10 percent penalty if payment is not received or postmarked by the United States Postal Service USPS on or before December. Board of Supervisors HILDA L.

Need the Personal Identification Number PIN which is printed on any original tax bill. Ttclacountygov and propertytaxlacountygov. Do not attach staples clips tape or correspondence.

Excluding Los Angeles County holidays. The annual bill has two payment stubs. The Government Website Experts Login.

Businesses with personal property and fixtures that cost 100000 or more must file a business property. AIN in the body of the email. The 2nd installment payment is due February 1 and becomes delinquent and subject to a 10 percent penalty by April 10.

2019 La Plata County 1101 East 2nd Avenue Durango CO 81301 970-382-6200 Powered by Revize. Note the original bill may still have the prior owners name on it the first year. BOX 54027 LOS ANGELES CA 90054-0027.

Delinquent Unsecured Tax information is only available by telephone or in person. Select the proper tax year in the drop down menu and click tax bill. 225 North Hill Street Room 115 Los Angeles California90012.

The property tax portal gives taxpayers an overview and specific details about the property tax process in Los Angeles County. If you pay the same bill twice or overpay taxes a refund may result. Please use the envelope enclosed with your Unsecured Property Tax Bill and include the payment stub from your tax bill.

If you do not receive the original bill by November 1 contact the County Tax Collector or Assessor for a duplicate bill. Each year business property statements which provide a basis for determining property assessments for fixtures and equipment are mailed by the Assessors Office to most commercial industrial and professional firms.

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal

Payment Activity Notice Los Angeles County Property Tax Portal

Secured Property Tax Bill Request Treasurer And Tax Collector

Copy Of A Property Tax Bill For La County Property Tax Tax Bills

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal